The secret to building a brand that truly stands out from the competition is understanding the market before anything else. But let’s be honest: when a small or medium-sized business hears the term “market research,” the first image that comes to mind is an expensive 100-page report commissioned by a multinational. It feels complex, time-consuming, and, above all, inaccessible.

On top of that, a few questions arise: What do you do after the research is done? How do you analyze the data and make sure it will have a positive impact on your operations? Is it even worth investing in market research without knowing whether the company will be able to implement the necessary changes afterward?

These are questions any manager with a limited budget will ask before making this kind of investment, which is why we’re going to address each one.

First of all, let’s understand exactly what we’re talking about.

We know that many small and medium-sized businesses operate based on the intuition or “gut feeling” of their owners. There’s nothing wrong with that—after all, this intuition comes from experience and deep knowledge of the market the business operates in. But as the company grows, relying solely on intuition becomes risky, and that’s where research comes in.

Market Research for Marketing, Branding, and Product – when to do it?

Market research is an effective (and essential) tool for reducing risk in any decision-making process. In marketing, branding, and product, its role is to map what competitors are saying, selling, and doing, as well as to clarify how your customer thinks.

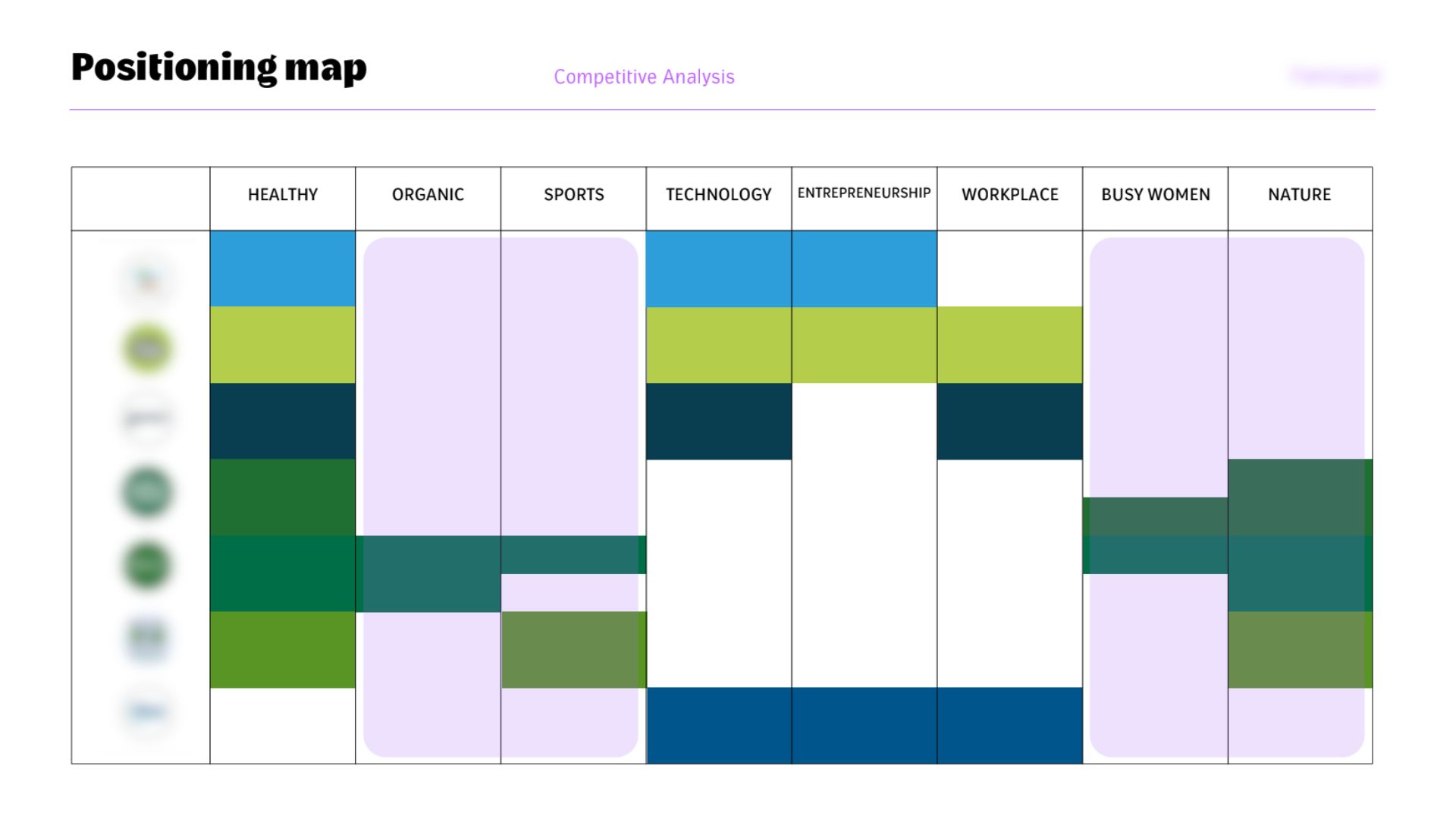

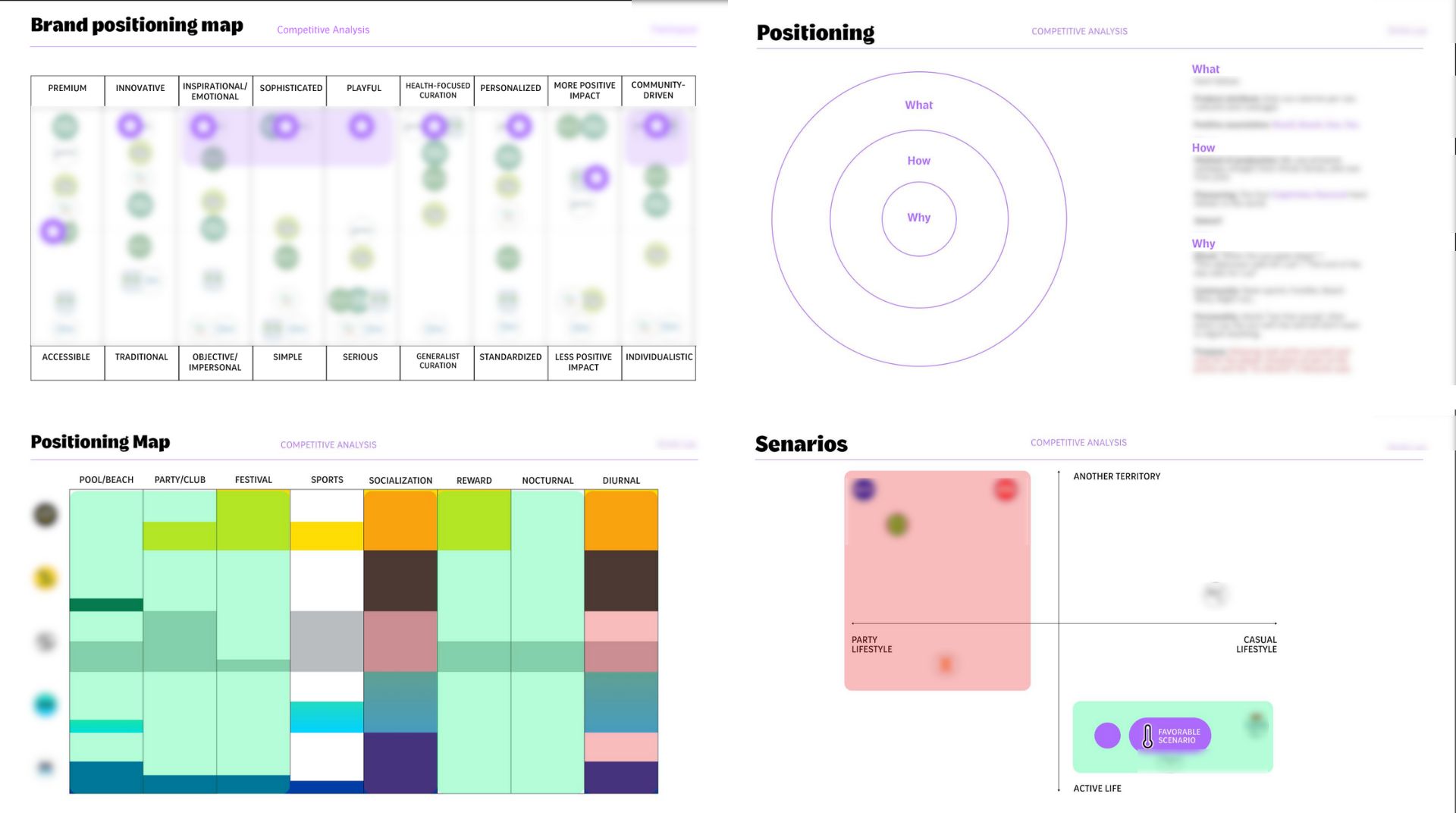

With that knowledge, it becomes easier to map best practices and strategies, identify trends in your segment, and outline a path to position your business in a differentiated, exclusive, and innovative way.

A market research process seeks to understand what competitors are doing and what customers are looking for, in order to identify unmet or underserved needs.

How much does market research cost?

The price of market research depends on the scope. The more robust the study and the larger the sample, the higher the cost. However, when it comes to small and medium-sized businesses, it’s still possible to achieve strong results and extract excellent insights in a fast and objective way.

It’s even possible to conduct the research internally with your marketing and product team, or to hire a consultancy specialized in SMBs (like Motora) prepared to design the ideal scope for your reality.

Market Research for Marketing, Branding, and Product – how to do it?

Every good research project should begin with a list of hypotheses, and its main goal is to validate or invalidate these assumptions so decisions can be made with more confidence.

To ensure more impartial results, the research team should maintain some distance from daily operations, reducing the risk of internal bias. That’s why hiring an external consultancy can be so strategic. With an unbiased perspective, it becomes easier to raise hypotheses impartially and avoid jumping to conclusions.

With your list of assumptions in hand, it’s time to validate them. This is usually the most time-consuming phase of any research process, and knowing the right tools makes all the difference.

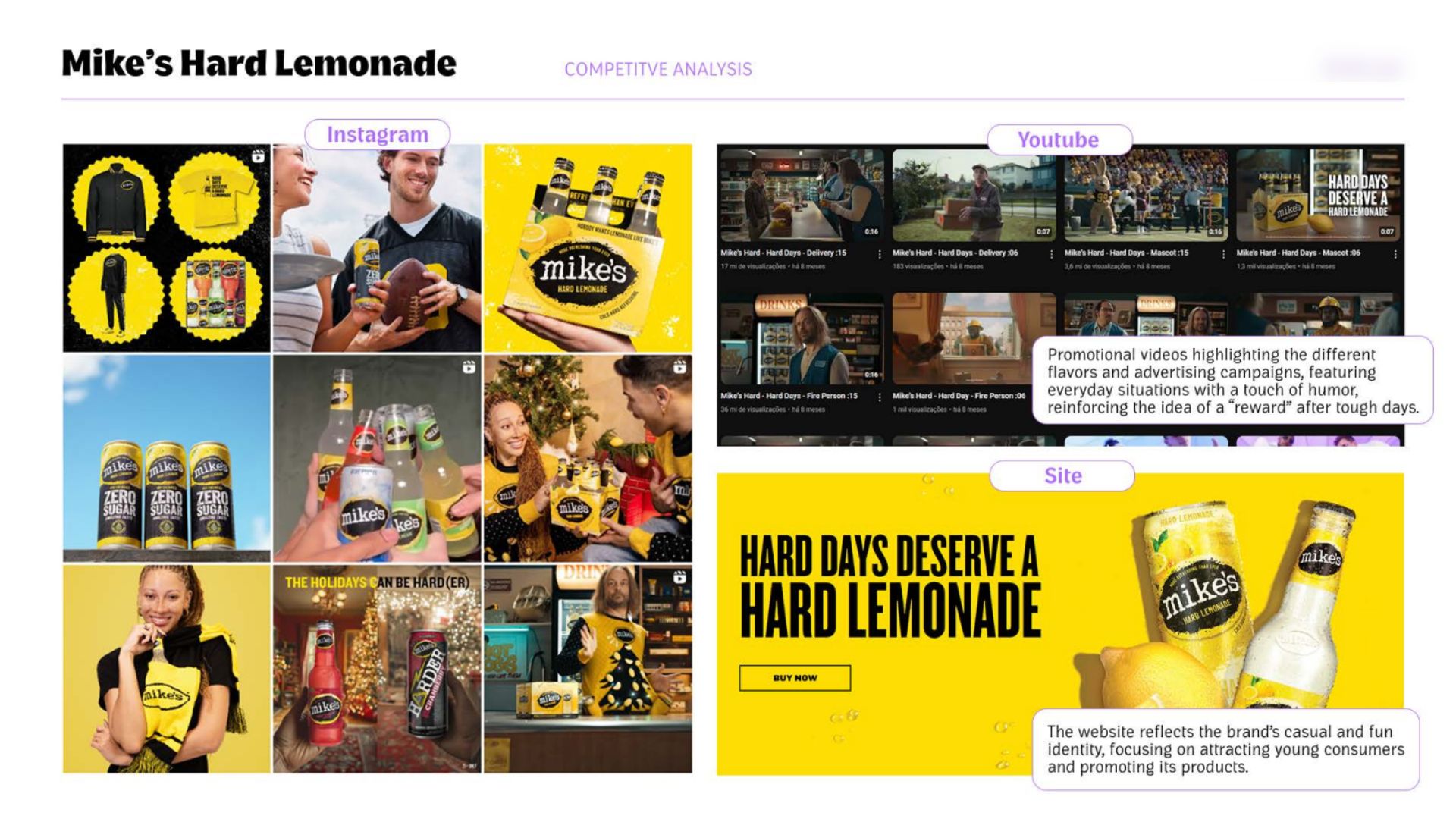

- Desk Research: Visit the websites of key competitors and map out what they’re doing: What do they say? How do they say it? What does their visual identity look like? Have they undergone any recent changes? What colors are most used? What products do they sell and how are they organized? Take note of all these observations.

- Social Listening: There are tools and software that analyze everything being shared on social media about a certain topic, brand, product, or niche. They can be extremely useful—but you can also perform manual research by checking forums, posts, and comments.

- Google Trends: A simple, free, and very helpful tool for understanding whether interest in a certain topic is increasing or declining, based on search volume. You can filter results by time period and even by region.

- Qualitative Research with Your Audience: Use your hypothesis list to create an interview guide and talk to people who do—or don’t—consume your brand.

- Quantitative Research with Your Audience: Again, starting from your list of hypotheses, create an online form to send to clients and non-clients. You can use your own database to distribute the survey or outsource the process.

What to do after the market research is completed?

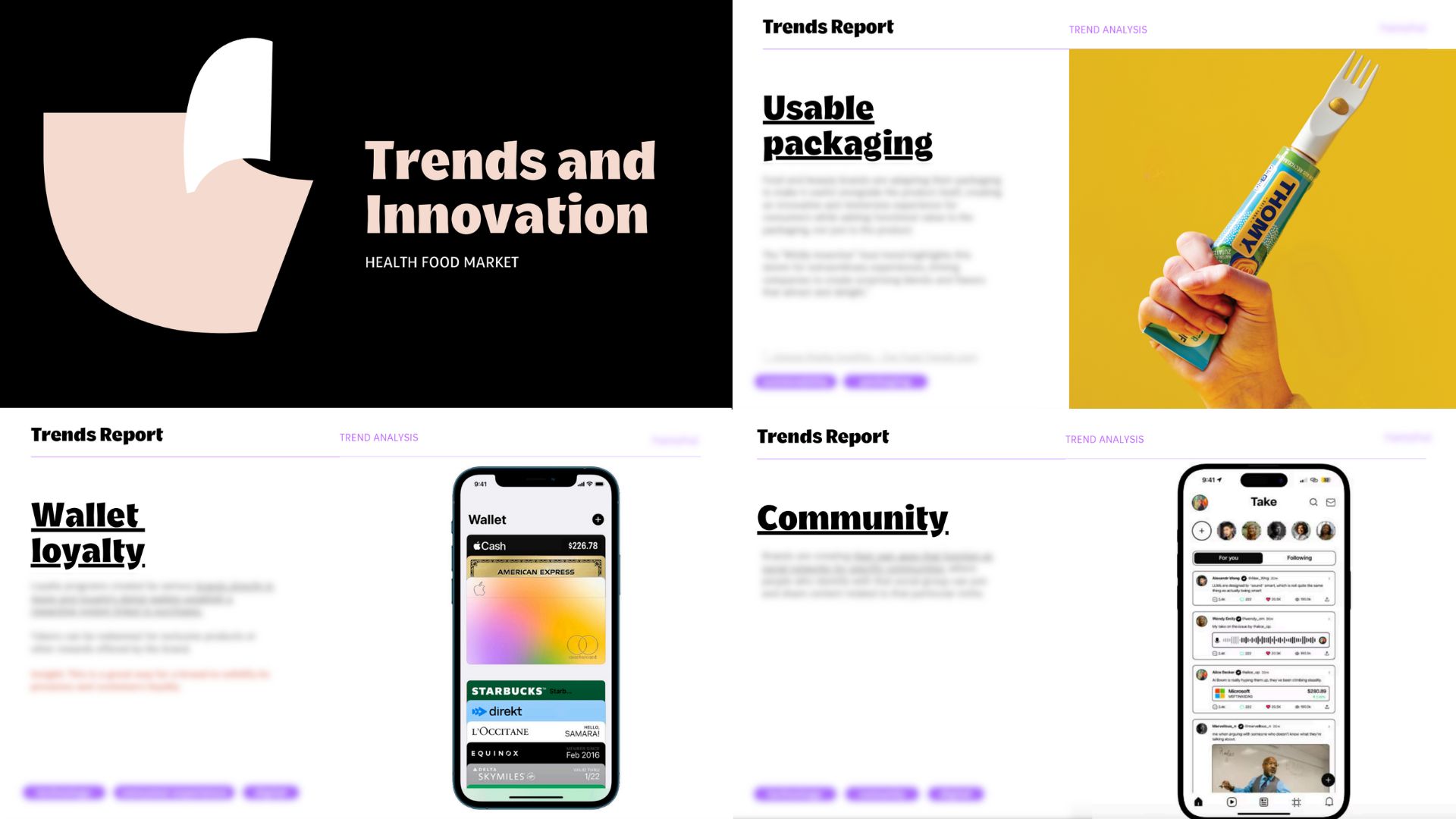

After completing all (or some) of the stages above, it’s time to synthesize everything into reports. Start by detailing the findings for each method, and you’ll naturally begin to notice patterns.

Use frameworks to build strategic maps that help you clearly visualize where the market is headed.

Go back to your list of hypotheses and actually answer each question raised at the beginning of the process. You’ll see that many will be reinforced, while others will no longer make sense at all.

How to turn market research findings into action

For small and medium-sized businesses, resources are limited—and making decisions based solely on intuition comes with major risks.

That’s why, with your research insights in hand, revisit the company’s entire plan and identify which actions still make sense and which no longer seem relevant. The savings from avoiding rework and failed launches can easily exceed the cost of the research itself.

In branding and marketing, adjustments in messaging, packaging updates, and campaign changes can be extremely quick, inexpensive, and capable of generating massive results when guided by solid research.

Now that you have all the tools needed to work with data and strategy, your next business move no longer needs to be a leap in the dark. Always think in terms of observing, researching, validating—and only then acting. This mindset will transform your organization’s results.